These figures are from a study conducted by the business school IESE based on an analysis of the investment operations of 25 funds of the Catalan financial entity in 207 companies.

The Institut Català de Finances (ICF) has helped to create 7,646 new jobs via its activity in venture capital investment, as shown by a study prepared by the business school IESE (in Catalan) on the economic impact of funds in which the ICF participates “The economic impact of funds invested in by the public Catalan financial entity.”

The Entrepreneurship department of the IESE studied the investments made by 25 venture capital funds part owned by the ICF in 207 companies 97% of which are start-ups and SMEs.

Venture capital is one of the alternatives via which the ICF provides access to financing for the business community, especially entrepreneurs, SMEs and medium size companies.

The ICF acts in this field as a driver and multiplier of resources for companies, co-investing with private investors in specialised funds that subsequently invest in the companies, either during the seed capital, venture capital or growth capital stage.

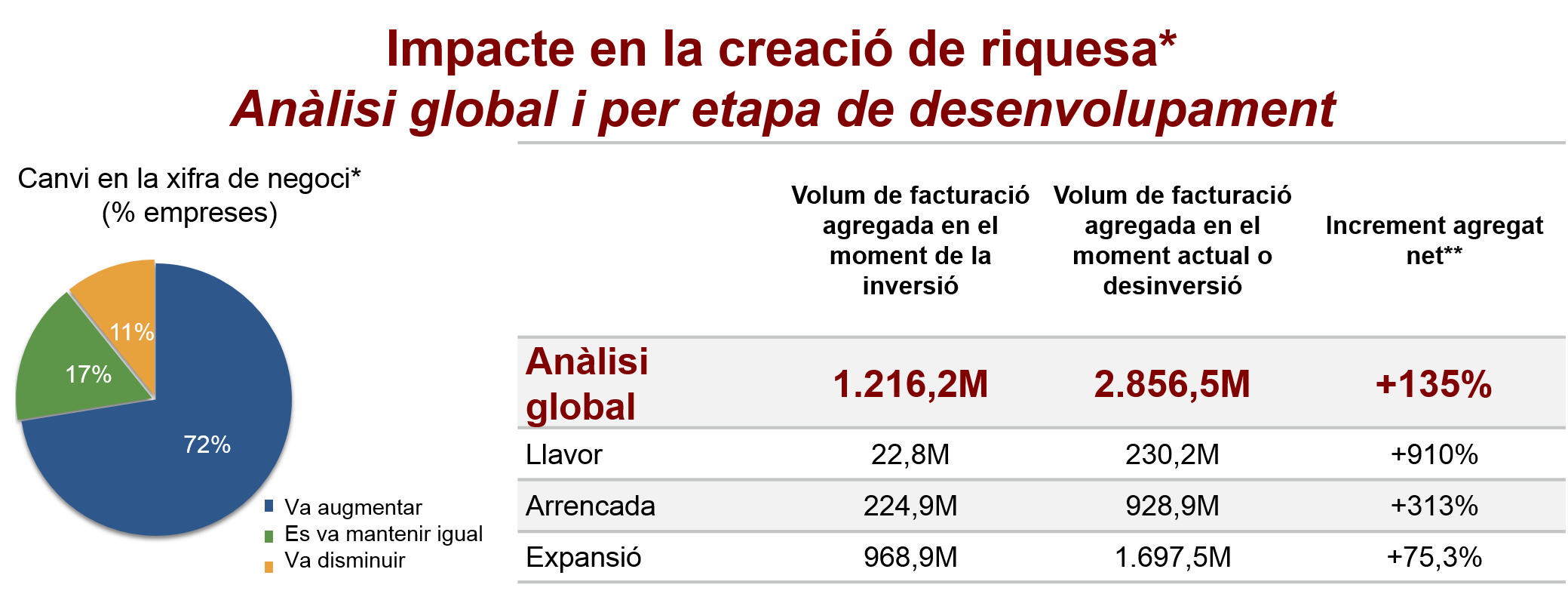

Investment by this fund has also helped to produce a 135% increase in the turnover of the companies receiving the investment, with a positive aggregate impact of over 1,640 million euros.

The study was conducted by the Entrepreneurship department of the IESE, headed by professor Joan Roure, which presented it this Tuesday inBarcelonaat a seminar on the role of venture capital in corporate development and economic growth.

The act was attended by the secretary general of the Treasury of the Department of Economics and Treasury of the Generalitat of Catalonia, Lluís Salvadó; the managing director of the ICF, Josep-Ramon Sanromà; the director general of corporate investments and capitals market of the ICF, Joan Carles Rovira; and almost a hundred representatives of venture capital funds, private investors, financial entities and members of the IESE Alumni community.

The Study: Objectives and Results

The objective of the study was to analyse the economic impact of the venture capital operations of the IC, and more specifically of the funds participated in by the Catalan public financial entity since its commenced operations in 2002.

In this regard, the investment operations of 25 funds part held by the ICF in 207 companies.

Types of investee companies

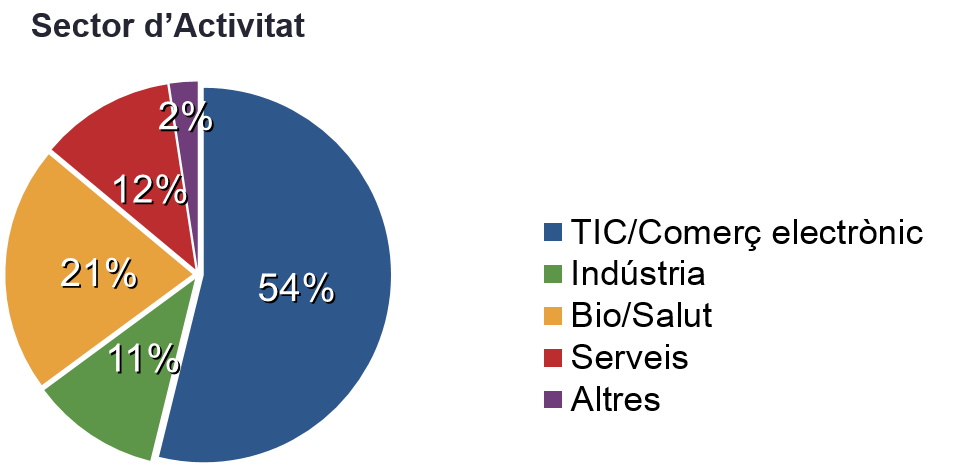

97% of the companies in which these funds have invested (investees) are start-ups and SMEs; 60% were created over the past 10 years, and 40% between 2008 and 2013, coinciding with the height of the economic crisis. By sectors, 54% are in the ICT sector and ecommerce, followed by the bio and health sector (21%), the services sector (12%) and industry (11%).

Fund investments

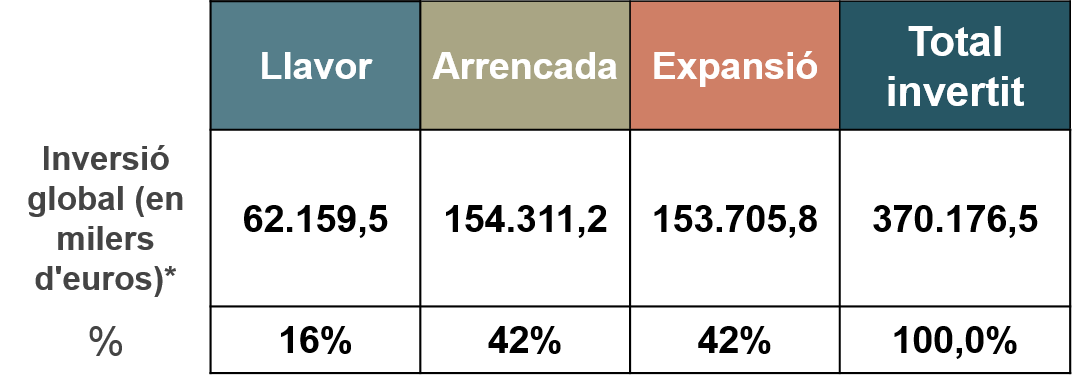

The 25 venture capital funds analysed had invested a total of 370 million until 31 December 2014, in these 207 companies. 16% of the companies at the seed capital phase and 42% in the start-up and expansion phase respectively.

The funds carried out 73% of this investment between 2008 and 2014, coinciding with the years of maximum economic slowdown.

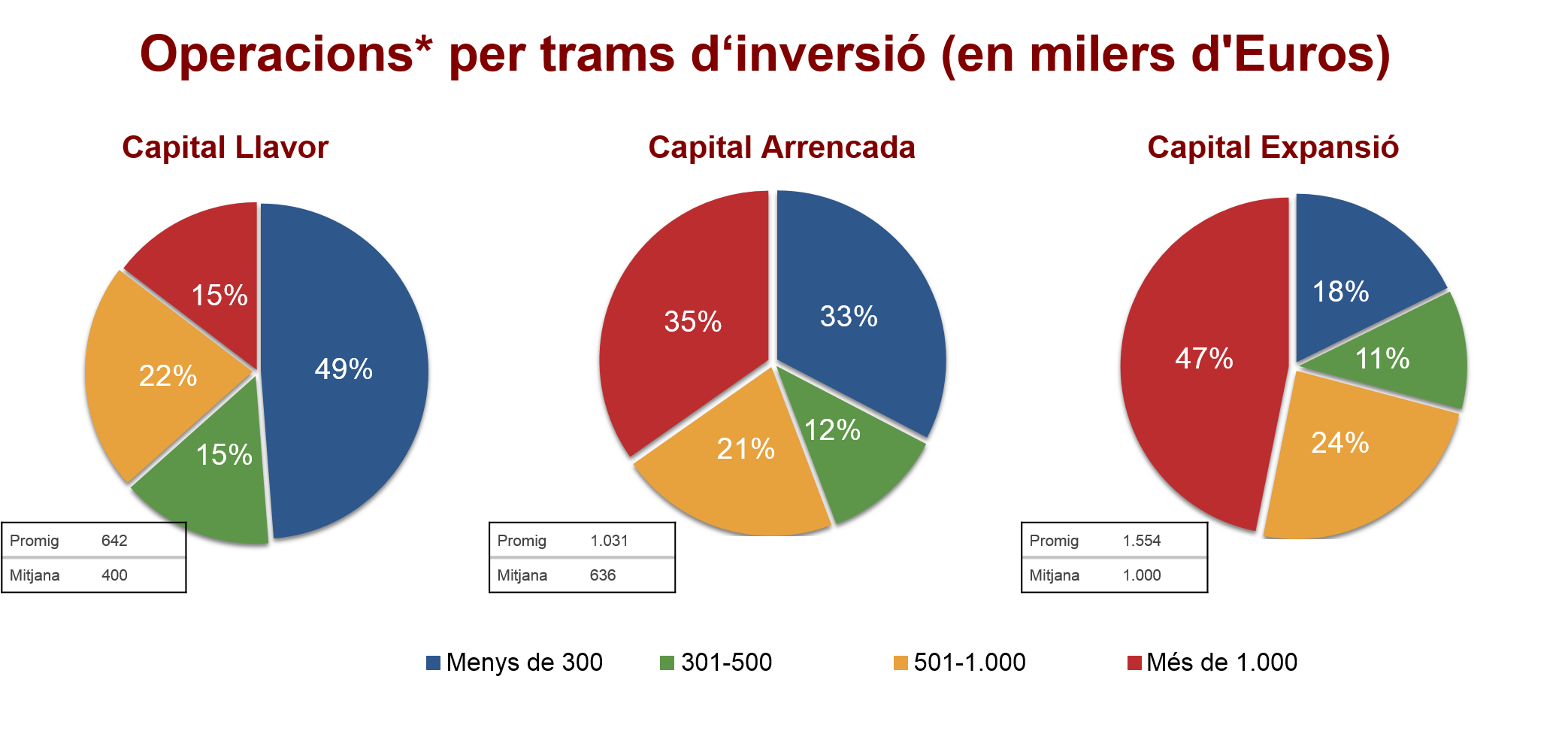

As regards seed capital, 50% of the investments were under 300,000 euros; as regards start-up capital, 56% of the operations exceed half a million euros; and in expansion capital nearly 50% were for one million euros, coinciding with the needs of the companies in accordance with their degree of development.

The companies at the seed and start-up capital stage mostly allocated these resources to research, intangible assets and development of their business structure while the expanding companies allocated them to infrastructure, research and other intangible asset and business structure.

At the time the study was carried out the funds continued to be present in 45% of the companies at the seed capital stage in which they had invested, had disinvested in 25% of cases and 30% of the companies failed. In start-up and expansion capital the funds continued in nearly 75% of the investees.

Impact of the investment and wealth creation

The investment by the funds part held by the ICF has helped to multiply the global turnover of the investees by 2.35 with a net increase of 135% an aggregated positive impact of 1,640 million euros.

The increase during the seed phase was notable, in which 77% of the investees grew after receiving the investment, multiplying the global turnover by 10.

Impact of the investments. Job creation

The investment by the funds part owned by the ICF helped to create over 7,600 new jobs.

The global increase in employment was 95%, if we compare the workers the companies had at the time of receiving the investment and the present (or in some cases at the time of disinvestment).

72% of the investees increased the number of workers: 69 new jobs per company, on average.

List of the 25 venture capital funds managed by the ICF surveyed/analysed

Active - amerigo

Invernova - Alter

BCN Emprèn

Caixa Capital Biomed

Caixa Capital TIC

Caixa Innvierte Biomed II

Caixa Innvierte Industria

Capital Expansió

Capital MAB

Finaves IV

Fons Mediterrania

Fonsinnocat

Highgrowth Innovació

Invercat

Inveready Bio

Inveready First

Inveready venture Finance

Nauta II

Nauta III

SICOOP

SIE

Spinnaker

Taiga V

Venturcap II

Ysios