The Catalan public financial entity financed 2% more companies than in 2015. 97% of the companies that received funding are SMEs and entrepreneurs. The ICF also invested 20.3 million euros in venture capital funds that invest in newly established companies and/or growing SMEs in Catalonia, a 16.7% increase.

The Institut Català de Finances (ICF) has presented the results of its activity during 2016. A year in which, in accordance with the strategic plan begun in 2011, it has continued to work on promoting and facilitating access to financing for the Catalan business fabric, especially for SMEs and entrepreneurs.

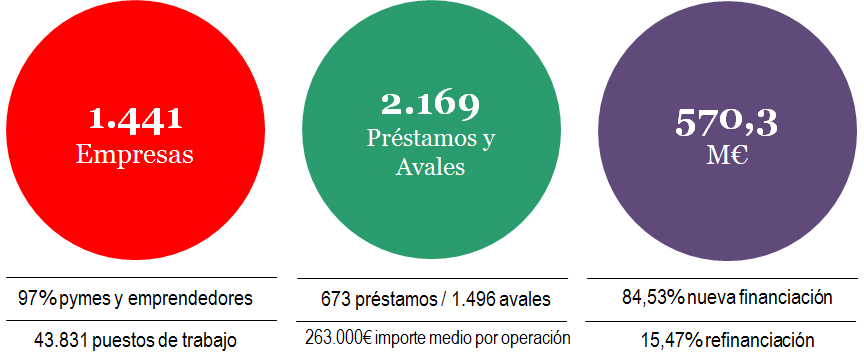

In 2016, the ICF Group financed 1,441 companies with 570.3 million euros through 2,169 loan and/or guarantee operations. 97% of the financed companies were SMEs and entrepreneurs.

The Catalan public financial entity funded more companies (up 2%) than in the previous year, although the amount for the loans and guarantees signed was lower (-18%). This is mainly due to the recovery of the private credit sector as the economy begins to grow again and the plentiful liquidity available in the commercial banking sector thanks to the ECB’s expansive policies. During the period of economic crisis, public banking has developed an anti-cyclical role, partly covering the lack of access to credit, especially for SMEs.

During the year, the ICF invested almost 280 million euros in direct loans to companies for new investments and working capital; 44.5 million euros in second-floor facilities, sharing the credit risk with banks in order to improve access to financing for the self-employed and small businesses; 158 million euros in guarantees to help businesses obtain bank loans; and 88 million euros in financial solutions to guarantee the viability of business projects. The average transaction value was 263,000 euros.

With this entire volume of financing, the ICF Group has helped create and/or maintain nearly 44,000 jobs.

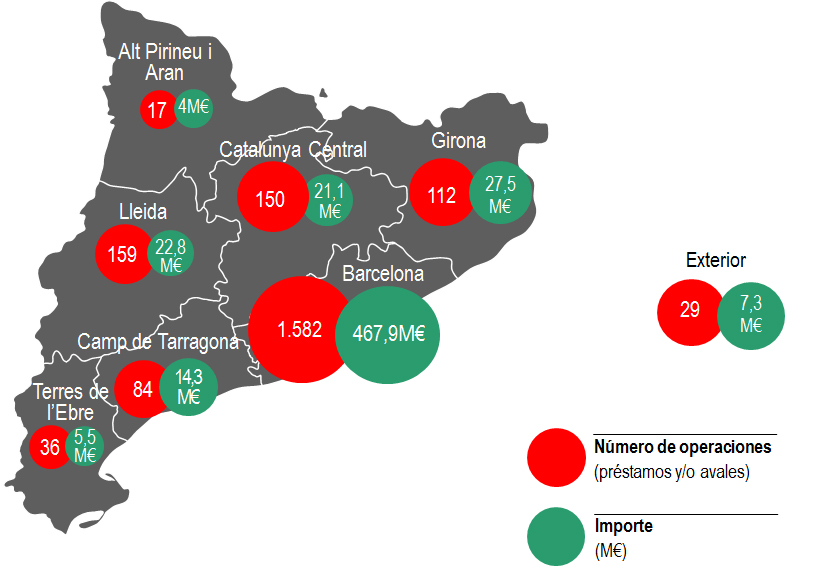

Geographical distribution

Regarding the territorial distribution of credit activity, the largest part is concentrated in Barcelona and its area of influence, both in terms of the volume of investment (80%) and the number of operations (70%). Girona (27.5 million), Lleida (22.8 million), Central Catalonia (21.1 million) and Tarragona (14.3 million) are, in that order, the following demarcations in terms of investment volume.

Activity in venture capital and participatory loans

In addition to its lending activity, in 2016 the ICF destined 20.3 million euros to risk capital funds that invest in newly created Catalan companies and/or growing SMEs, 16.7% more than the previous year.

In this area, the Group acts as a fund of funds. It cooperates and co-invests with the specialised private sector, identifying the gaps in the market and acting as a driving force for achieving more investment for companies operating in Catalonia.

At present, the ICF participates in 33 risk capital instruments, in which a total volume of 151.5 million euros is committed and has contributed to mobilising nearly 1,000 million euros from other investors.

Overall, the investment capacity of these 33 instruments totals more than 1,100 million euros, of which 55% has already been invested in 316 companies in the ICT, digital, life sciences, industry and services fields.

The ICF also has a co-investment facility with private investors for start-up companies through participatory loans of between 50,000 and 200,000 euros. In 2016, through this facility, the entity financed 16 start-ups with a total of 2.4 million euros.

Indicators and results

The ICF Group ended 2016 with results of 9.8 million euros, which will be allocated entirely to reserves.

Regarding the other indicators, the entity recorded a solvency ratio of 33.5%, a default ratio of 12.2%, and a coverage ratio of 75.8%.

Lending activity 2011-2016

Since 2011, coinciding with the reorientation of the activity, the ICF Group has facilitated access to finance for 13,896 companies, 97% of which are SMEs and entrepreneurs, for an overall amount of 4,289 million euros, through 17,730 loan and/or guarantee transactions.

In the last five years, the ICF has accumulated a profit of 41.3 million euros that has allowed it to strengthen its own resources, doubling its solvency coefficient.

The soundness of its balance sheet, together with the liquidity and quality of the assets, has allowed it to strengthen and expand its ability to carry out its activity.

Customer Satisfaction Survey

In 2016, the ICF carried out a customer satisfaction survey to evaluate the service it gives to companies. According to the results of the survey, the customers rated at 7.89 the service offered by the entity and highlighted the treatment, professionalism and assessment.

Half the customers declared their intention to continue working with the entity and said that they would recommend it to other companies without reservation. With regard to the opportunities for improvement, customers emphasised the operational agility and the strengthening of dissemination and promotion actions.

89% of the customers consulted also said they were satisfied or very satisfied with the coverage of the funding needs by the ICF. Along the same lines, 74% of the companies consulted were satisfied or very satisfied with the conditions of the financing operation they signed with the entity.

Finally, 3 out of 4 companies say that their business has been strengthened thanks to the ICF’s financial support, highlighting the improvement in efficiency and competitiveness (21.2%), the improvement in equipment and installations (19.8%) and recruitment of new workers (17.7%).